5 Tips about ssn You Can Use Today

5 Tips about ssn You Can Use Today

Blog Article

A overseas delivery certification, if It is out there or maybe the applicant can attain it within just 10 days (Otherwise, Social Security may well settle for the copyright or immigration papers as evidence of age)

Hey Levente! No concerns ;) While I haven’t utilized that actual iPhone fax application, if it could ship and acquire faxes, it should really work fine. Be at liberty to write-up an update to substantiate When you Get the EIN!

And don’t fret, this doesn’t power your LLC into performing this forever. You may as well alter your LLC’s line of labor Anytime therefore you don’t really need to update the IRS. This information is just required over the LLC’s Original EIN software.

You are very welcome Yado! The IRS is de facto backed up. The present situation is introducing massive delays… and December and January may also be extremely active months. Please see Oleksii’s reply underneath. It’s actually greatest to just wait around and Wait and see. Sending in numerous SS-4s just isn't a good idea. It may cause issues. In all of my experience While using the IRS, the IRS doesn’t skip documents or reduce points. It just normally takes for a longer time than predicted at times. And what’s happening at this time on the earth has not occurred before.

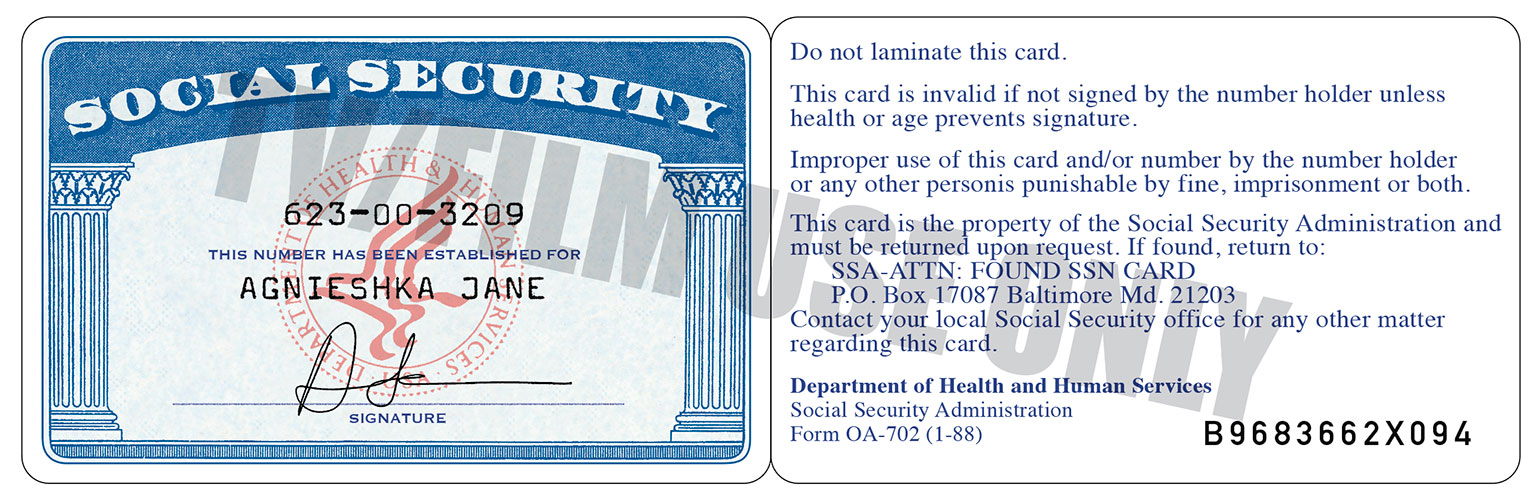

Hi Radu, yes, the SSN remains legitimate and it may be used to get an EIN in your LLC. When you have the SSN number, but don’t hold the SSN card, you can use the SSN number when making use of for an EIN (you can in fact apply for an EIN online), nonetheless, in case you don’t provide the number, it seems fairly tough to get yourself a substitute in the problem.

I known as the IRS when you suggested (1.two months right after fax), and also the agent corroborated the forty five company times and explained they had introduced a Memo and are necessitating extra paperwork from foreign applicants. He explained, some can get turned down if it appears They may be filing the LLC to stop taxes within their dwelling nation ( no nexus during the US).

You are actually leaving AARP.org and planning to a web site that isn't operated by AARP. A special privacy learn more about new social-security-card-online-ssn plan and terms of services will implement.

I’m non-resident alien. 3 several years ago I’ve acquired EIN variety IRS like a foreign particular person by telephone contacting for selling on Amazon. I’ve now shaped solitary member LLC in Wyoming and I need EIN for my LLC.

Thank you Matt, thanks a great deal for your prompt reply and in depth tips. I’ll try and simply call the IRS.

Using the IRS, you can just use your house handle in your nation. The deal with doesn’t must be the address of the LLC. To the IRS, it’s simply just a “mailing address” which can be Positioned anyplace on the earth. Hope that helps.

All files should be originals or copies Licensed because of the issuing company. Photocopies or notarized copies won't be accepted.

Most of our notices are get more information about new social-security-card-online-ssn actually obtainable online. With all your account, you may elect to get available notices online in lieu of by mail and may choose to get email or textual content alerts when you have a observe obtainable.

Be aware: Most foreigners gained’t have wages or annuities compensated, get more information about new social-security-card-online-ssn so this area is probably not applicable. Most foreigners will just enter “N/A”.

Ask for a substitution SSA-1099 or SSA-1042S, the forms the agency mails to you every January for tax uses that summarize your Advantages to the past calendar year.